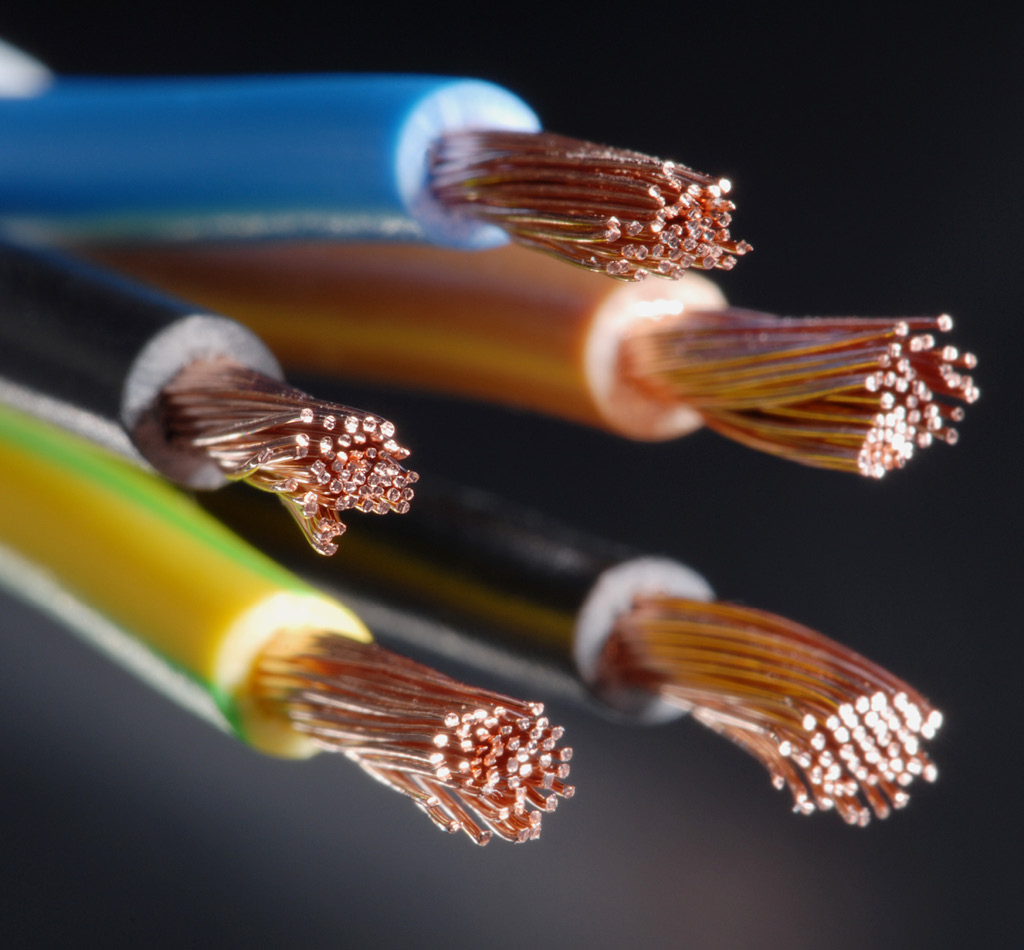

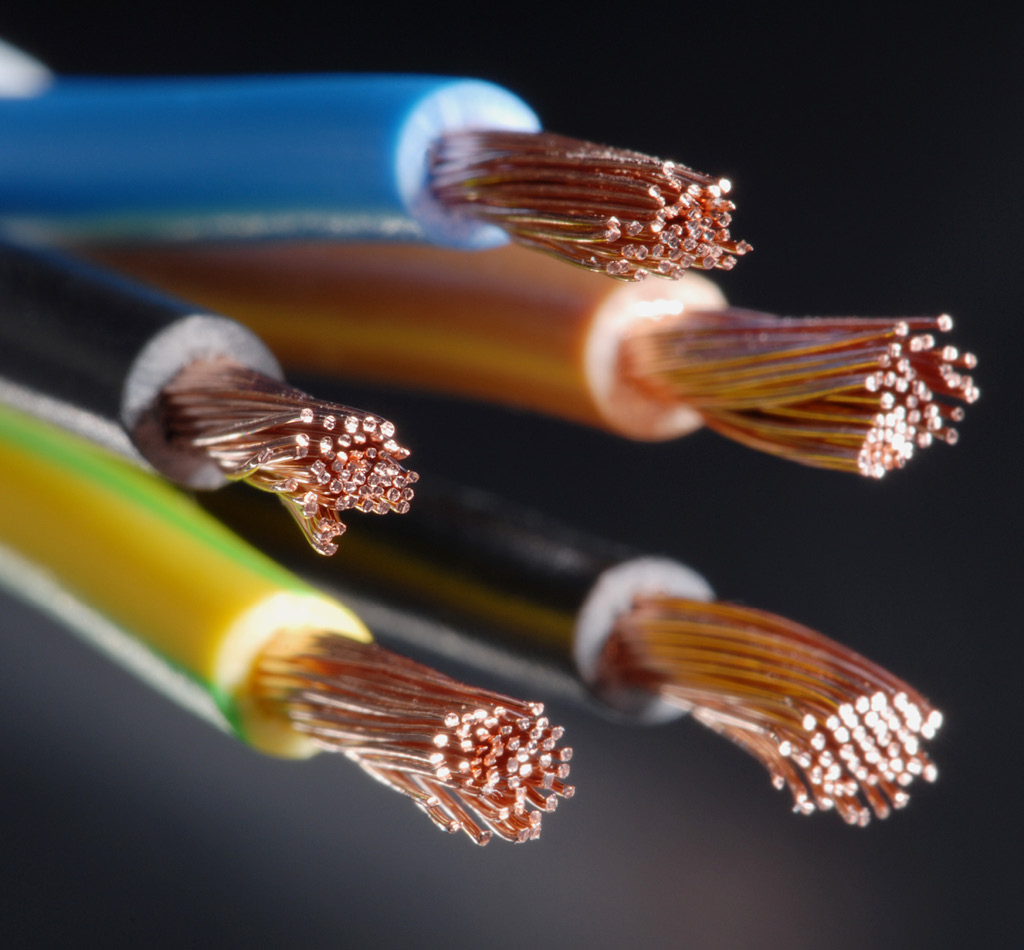

Capstone Copper: Positioned to benefit from a structurally tight copper market

February 12, 2026 | Global Alpha Capital Management

Copper markets are entering a structurally tight phase while Chile’s evolving policy backdrop is improving the outlook for long-life, capital-intensive mining assets.

US deposit distortion confirmed

February 11, 2026 | NS Partners

The Fed’s Public Affairs office has confirmed that a large rise in demand deposits in late 2025 reflected a reporting change.

MENA Q4 2025 Manager Letter

February 10, 2026 | Vergent Asset Management

In our 4th quarter investor letter, we discuss our views on the MENA equity markets and the main return drivers for the strategy during the quarter.

Monetary tremors

February 6, 2026 | NS Partners

Recent market turbulence could reflect an adverse shift in “excess” money conditions.

Fade the manufacturing bounce

February 3, 2026 | NS Partners

An expected PMI pick-up is under way but money trends suggest another relapse from Q2.

Eurozone / UK money update: UK relative recovery

January 30, 2026 | NS Partners

Eurozone and UK money trends have shown disappointingly small responses to policy easing.

Five reasons European retail brokerages keep outperforming

January 29, 2026 | Global Alpha Capital Management

Retail investors have reshaped markets, and European brokerages have been among the biggest beneficiaries.

US money update: mixed signals

January 28, 2026 | NS Partners

US narrow money is growing slowly, casting doubt on expectations of economic strength.

Forecast – 2026

January 21, 2026 | CC&L Investment Management

After three consecutive years of strong equity returns, the investment environment entering 2026 is shifting.

Weaker monetary news

January 20, 2026 | NS Partners

Early numbers suggest that global six-month real narrow money momentum fell back sharply in December.

US broad money update: low household cash ratio

January 16, 2026 | NS Partners

The share of money holdings in household financial wealth is near the bottom of its range since the mid-2000s, with equity exposure at a post-WW2 record.

Five ESG trends for 2026

January 15, 2026 | Global Alpha Capital Management

Despite some recent pushbacks, ESG is here to stay and remains a critical lens for identifying material risks and long-term value in a changing world. Here are five key ESG trends shaping 2026.

LatAm’s rightward political shift is fuelling a continent-wide bull market

January 13, 2026 | NS Partners

Following years of economic pain brought about by loose fiscal policy under socialist leaders, a “blue wave” of fiscal conservatism is sweeping across the continent. More muscular regional foreign policy by the United States is likely to reinforce the trend.

2025 year in review – the glistening Great White North

January 8, 2026 | Connor, Clark & Lunn Financial Group

Despite a year of geopolitical unrest and trade challenges, investors saw robust portfolio growth with strong Canadian equities and a broadening of stocks away from the Magnificent Seven.

Navigating the global versus home-country equity bias decision

January 8, 2026 | Connor, Clark & Lunn Financial Group

While some investors may go all-in on global equities, there are several advantages for having a Canadian-equity bias.